Economic crises do happen from time to time, often leading to recessions and depressions. The 20th century alone marked the occurrence of several crises, including natural disasters, geopolitical events and systemic failures, which caused markets to drop significantly. The recent outbreak of the coronavirus (Covid-19) is turning out to be another major crisis, which, as expected, has distressed hugely both stock and bond markets globally in the past month. Although the potential economic impact of the pandemic is still early to assess, it is certain that containment measures, with economic activity shutting down in many countries, will significantly affect economic growth.

In the present chaotic market environment, many people are prone to panic and may not act rationally. They will focus on the losses they incur and totally ignore the fact that lower prices may actually present buying opportunities. During this time, instead of engaging in fear-based changes, investors should be patient, ignore the noise, and continue with a disciplined investment strategy.

Here are a few tips on how to navigate extreme market conditions:

1. Stick to your investment plan

Your investment strategy should always match your investment horizon, your investment objectives and your appetite and tolerance to risk. Once you have determined your suitable asset allocation mix, maintaining discipline is vital to reaching your goals. You will have to deal with changes in the economic environment, the markets, your career, the needs of your family, and more. One of the greatest challenges you will face is managing your emotions when markets rise and fall.

2. Time in the market is what matters

If you have a long term investment horizon, investing in a strategy with a higher potential for growth but greater risk may be a good idea, as you have the luxury to ride out any periods of investment losses. If, on the other hand, you are close to needing the money, it is often a good idea to reduce the risk in your portfolio to mitigate against sudden market movements.

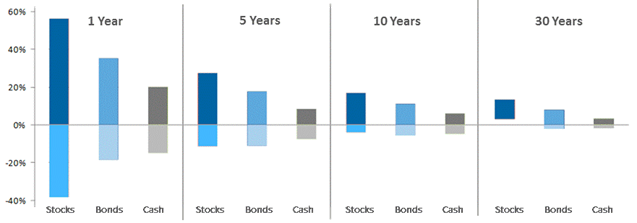

The chart below shows the historical dispersion of returns in stocks, bonds and cash during different time horizons. Stock returns have historically outpaced bond and cash returns but, as you can see, have a wider range of ups and downs (volatility) in the short term. In comparison, bonds and cash returns are less volatile than stocks, although in extreme market conditions they do have significant swings as well. The important takeaway of the graph, though, is the fact that the more time you are invested in the market these short term shocks even-out and in the long term positive returns are expected.

Distribution of Annualised Real Returns (1900-2017)

Source: Credit Suisse AG

3. Don’t try to time the market

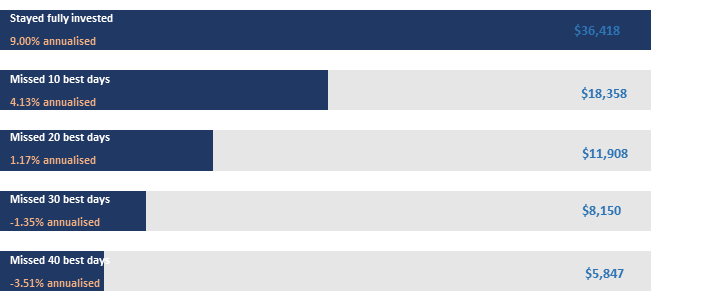

A few poorly-timed moves, like buying when markets are high and selling when they are low, or staying out of the market when it recovers, can have a dramatic effect on the performance of your portfolio. Trying to time the market is not only difficult to achieve but risky as well, as trying to avoid the worst drops means you may also miss the opportunity for gains.

The graph shows the hypothetical value of a $10,000 investment in the S&P 500 Index from 31/12/2004 to 31/12/2019. If an investor had stayed fully invested for the duration of the period he would end up with $36,418. On the other hand, if the investor attempted to time the market and missed the best days of that period, he could end up with significantly less return.

$10,000 invested in the S&P 500 Index (31/12/2004 to 31/12/2019)

4. Invest consistently, even in bad times

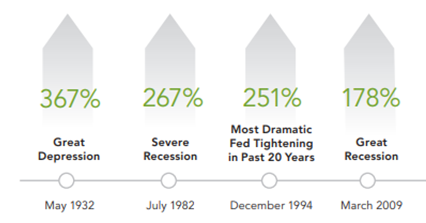

History has shown us that some of the best times to buy stocks have been when things seemed the worst. Consistent investing regardless of market conditions can give you the discipline to buy stocks when they are at their cheapest and benefit from the excess returns that follow.

The below diagram illustrates that the subsequent performance of US Stocks following market crises has been impressive.

Subsequent 5-year returns of S&P 500 Index

Sources: Ibbotson, Factset, FMRCo, Asset Allocation Research Team

Concluding, it is worth remembering that crises and subsequent market downturns are fairly common, have rarely been predicted and irrespective of their cause, are part of normal, healthy market cycle. At these challenging times investors need to keep calm and remember that each market drop may offer a good entry opportunity, especially if you have a long term investment horizon. At the same time whether you are saving for retirement or to meet other financial goals, you need to ensure that you are in the right strategy, do not try to time the market, but rather stick to a disciplined investment approach.